Real-Time price data by Tradingview and Index maket data by Finlogix

ISTOCKNOW COMPUTER SOFTWARE LLC. ("StockNow") is not an investment adviser, a securities broker-dealer, or any other type of financial professional. No content on the StockNow site should be considered an advice, an offer, or solicitation of an offer to buy or sell any securities or any other type of investment or financial product.

By using the "StockNow" platform, you understand and agree that "StockNow" does not recommend any security, transaction, or order, does not issue securities, does not produce or provide research, does not provide any investment advice. For full disclaimer, please see here. Check our cookie policy, and our privacy disclosure as well.

OMER: PATH to breakeven (two)

Mar 11, 2025, 12:15 PM, PDT Author: 007Q

Thank you to everyone in the stocktwits.com OMER community for your continued support. I'd especially like to acknowledge Chris (@ipdamages) whose valuable feedback on my previous post "OMER: A bullish prediction on its PATH to breakeven" prompted this update. In this article, I'll revisit my projections for Omeros Corporation's timeline to breakeven - that critical juncture when revenue matches expenses and the company begins generating profit.

Disclaim: The following analysis is based on historical data and industry trends, and does not constitute financial advice. Investing in biotech companies can be highly volatile. It's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Always consult with a financial advisor for personalized advice. Disclosure, the Author is a long term OMER investor.

Previous prediction

Based on conservative revenue forecasts, if Narsoplimab captures 30% of the projected target in 2026, this would generate approximately $157 million in sales. I believe Omeros will achieve break-even profitability by the end of 2026.

Revised factors

1. Operating Cost

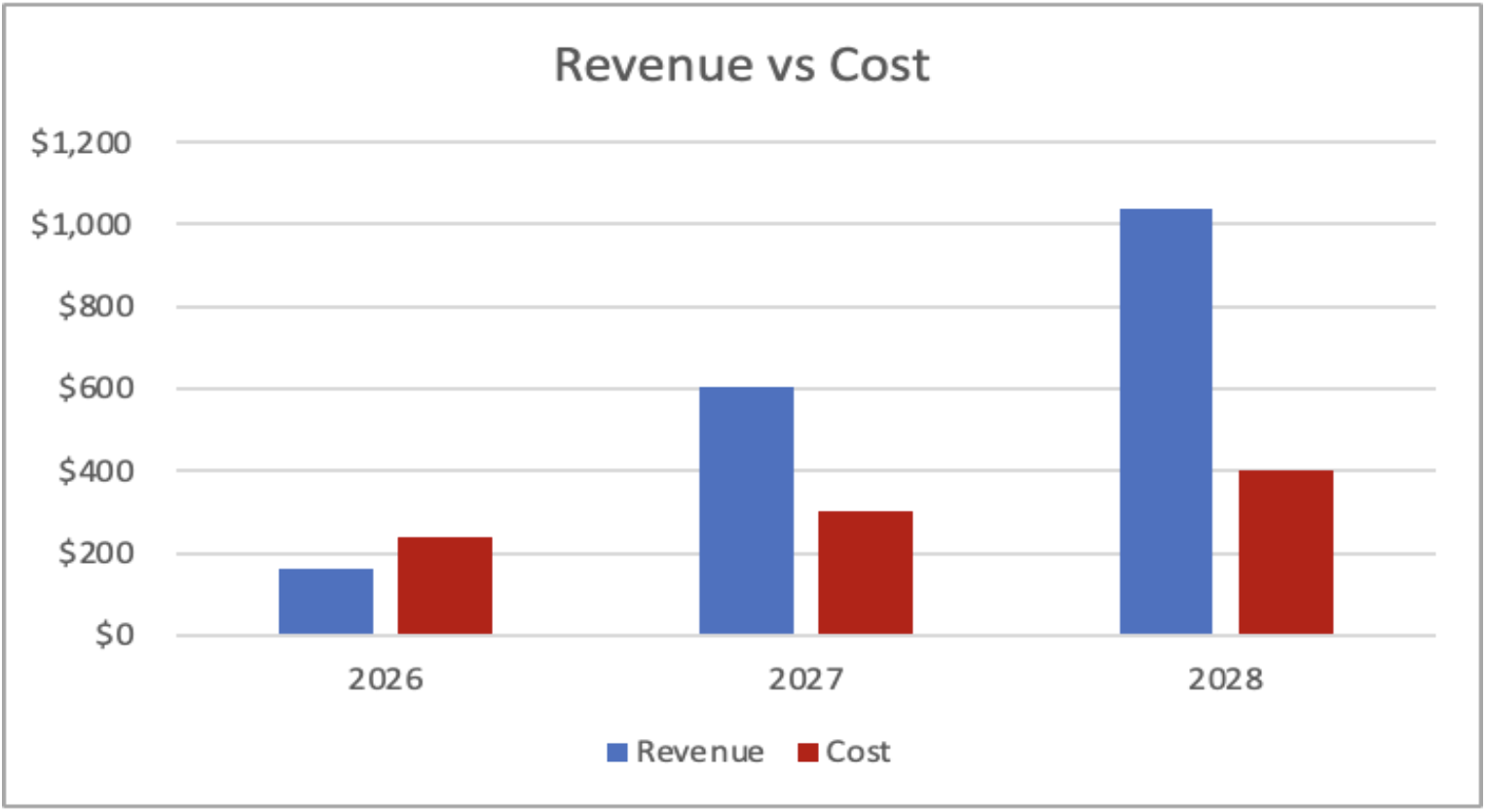

Omeros will likely increase operating costs for commercialization efforts, including expanding their sales force, product labeling, launch activities, and drug manufacturing. Additionally, the company will probably allocate more resources to accelerate the Phase 3 trials of Zaltenibart (OMS-906) for PNH and C3G indications. Assuming these expanded initiatives, we can project that annual costs will increase from the current $160 million to around $240MM, $300MM, $400MM annually starting 2026.

2. Pricing

If we consider a potential price range of $20,000 to $40,000 per dose, we can use $30,000 as a reasonable pricing estimate to simplify our prediction variables.

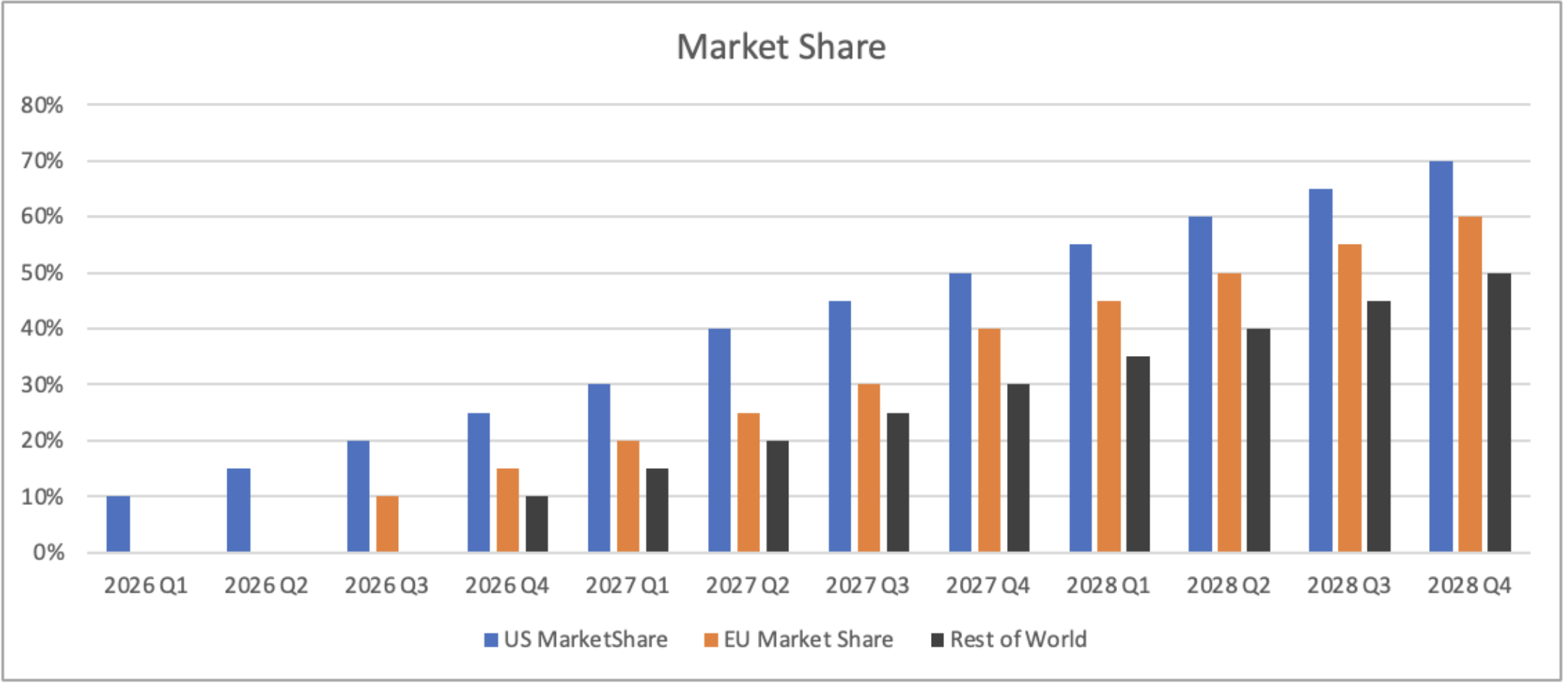

3. Market share

Assuming Narsoplimab receives FDA approval by Q4 2025, US sales would commence immediately, though market share will grow gradually. We project a 10% market capture in Q1 2026, increasing by 10% each quarter with effective execution. For the European market, timelines may extend longer without a partnership approach, though partnering would reduce Omeros' revenue share. Let's project EMA approval in 1H 2026, with sales beginning in 2H 2026. Under a European partnership model, Omeros would retain approximately 70% of revenue. We'll apply similar market share growth projections to estimate European revenue.

4. Patients

In our previous analysis, we employed conservative population estimates across regions. Based on those projections, the patient populations are approximately 1,897 in the US, 2,619 in the EU, and 2,117 in the rest of the world.

|

Global |

US |

EU |

|

|

Low |

6633 |

1897 |

2619 |

|

Medium |

9164 |

2621 |

3619 |

|

High |

13382 |

3827 |

5284 |

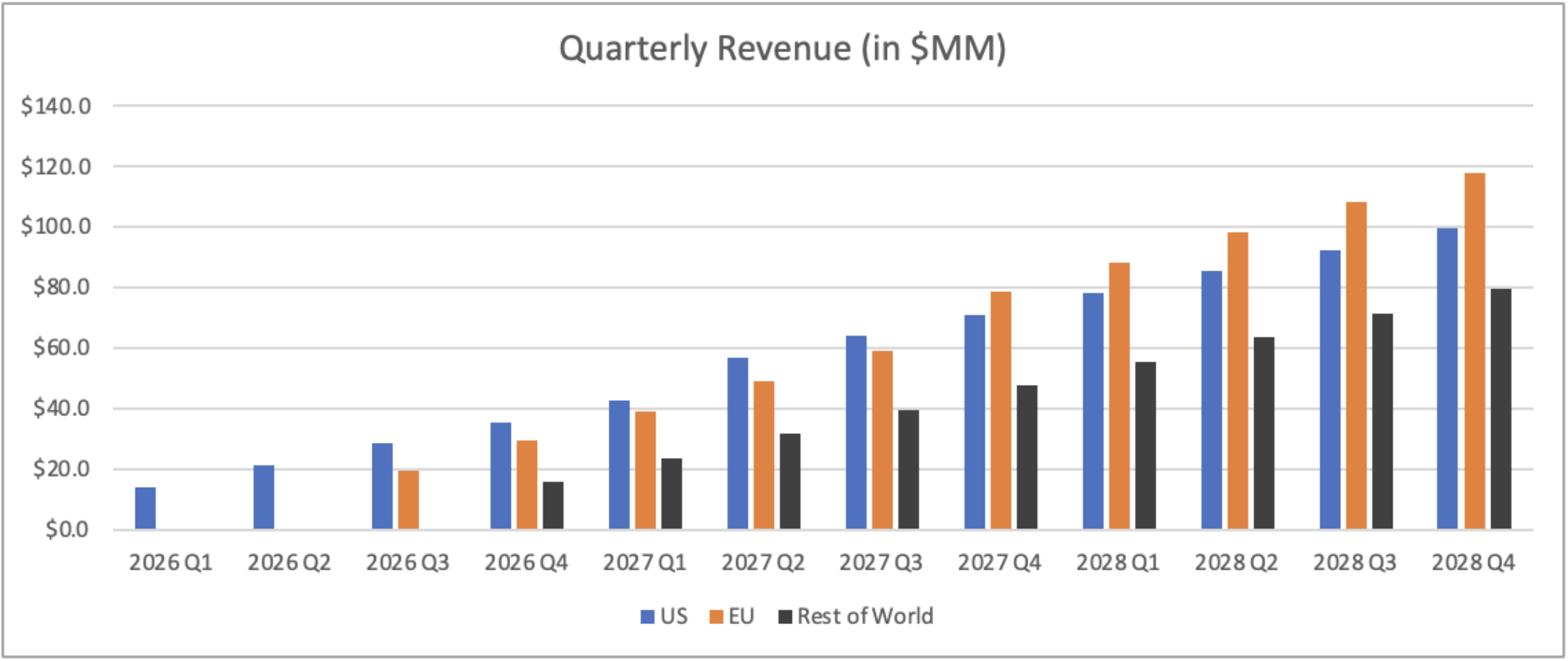

Revenue Forcast ($MM)

|

Date |

US |

EU |

Rest of World |

US MS |

EU MS |

RoW MS |

|

2026 Q1 |

$14.2 |

0 |

0 |

10% |

0 |

0 |

|

2026 Q2 |

$21.3 |

0 |

$0.0 |

15% |

0 |

0% |

|

2026 Q3 |

$28.5 |

$19.6 |

$0.0 |

20% |

10% |

0% |

|

2026 Q4 |

$35.6 |

$29.5 |

$15.9 |

25% |

15% |

10% |

|

2027 Q1 |

$42.7 |

$39.3 |

$23.8 |

30% |

20% |

15% |

|

2027 Q2 |

$56.9 |

$49.1 |

$31.8 |

40% |

25% |

20% |

|

2027 Q3 |

$64.0 |

$58.9 |

$39.7 |

45% |

30% |

25% |

|

2027 Q4 |

$71.1 |

$78.6 |

$47.6 |

50% |

40% |

30% |

|

2028 Q1 |

$78.3 |

$88.4 |

$55.6 |

55% |

45% |

35% |

|

2028 Q2 |

$85.4 |

$98.2 |

$63.5 |

60% |

50% |

40% |

|

2028 Q3 |

$92.5 |

$108.0 |

$71.4 |

65% |

55% |

45% |

|

2028 Q4 |

$99.6 |

$117.9 |

$79.4 |

70% |

60% |

50% |

Yearly Revenue and Cost ($MM)

|

Year |

Revenue |

Cost |

|

2026 |

$164 |

$240 |

|

2027 |

$603 |

$300 |

|

2028 |

$1,038 |

$400 |

Conclusion

According to our revised conservative revenue forecasts, Omeros is projected to achieve break-even profitability in 2027. Looking at the long-term valuation potential, the company could generate up to $1 billion in revenue from Narsoplimab alone. This revenue potential suggests a company valuation ranging from $5 billion to $10 billion. Importantly, this estimate does not include additional value from other promising candidates in Omeros' development pipeline. I will update these revenue projections following any significant catalyst events that may impact the company's outlook.