Real-Time price data by Tradingview and Index maket data by Finlogix

ISTOCKNOW COMPUTER SOFTWARE LLC. ("StockNow") is not an investment adviser, a securities broker-dealer, or any other type of financial professional. No content on the StockNow site should be considered an advice, an offer, or solicitation of an offer to buy or sell any securities or any other type of investment or financial product.

By using the "StockNow" platform, you understand and agree that "StockNow" does not recommend any security, transaction, or order, does not issue securities, does not produce or provide research, does not provide any investment advice. For full disclaimer, please see here. Check our cookie policy, and our privacy disclosure as well.

OMER: A bullish prediction on the PATH to breakeven

Jan.20,2025, 12:38 AM, PT Author: 007Q

Omeros Corporation, a Seattle-based biotech company, is dedicated to developing innovative treatments for a range of medical conditions, including immunological disorders, cancers, and addictive disorders. With a promising pipeline of drug candidates and a team of experienced professionals, Omeros is well-positioned to become a significant player in the pharmaceutical industry.

This article will attempt to make a prediction on the potential timelines for Omeros to reach a breakeven point, which is the point at which the company's revenue equals its expenses, and it begins to generate a profit.

Important Note: The following analysis is based on historical data and industry trends, and does not constitute financial advice. Investing in biotech companies can be highly volatile. It's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Always consult with a financial advisor for personalized advice. Disclosure, the Author is a long term OMER investor.

2024 quarterly earning recap

A review of Omeros' first three quarterly earnings reports in 2024 provides some insights into the company's financial performance. During this period, Omeros' quarterly income ranged between $5 million and $9 million, while its net loss was between $32 million and $56 million. Based on this information, it can be assumed that Omeros will continue to operate with a similar staff level and research and development (R&D) cost, approximately $40 million per quarter.

Given these financial trends, this article will attempt to make a prediction on the potential timelines for Omeros to reach a breakeven point, the point at which the company's revenue equals its expenses, and it begins to generate a profit.

-

Q1 2024:Net loss: $37.2 million; Net loss per share: $0.63; Net loss from continuing operations: $43.9 million; Net income from discontinued operations, net of tax, was $6.7 million

-

Q2 2024: Net loss: $56.0 million; Net loss per share: $0.97; Net income from discontinued operations, net of tax, was $9.1 million

-

Q3 2024: Net loss: $32.2 million; Net loss per share: $0.56; Net income from discontinued operations, net of tax, was $4.9 million

Assumption of BLA approval timeline

Moving forward, Omeros is banking on its next potential blockbuster drug, Narsoplimab, to provide a significant revenue stream. The company is currently working to resubmit the Biologics License Application (BLA) for Narsoplimab in the first quarter of 2025. If approved, the drug could receive FDA clearance as soon as June 2025, or as late as the fourth quarter of the same year.

Revenue forecast

When forecasting Narsoplimab's future revenue, several key factors are crucial for an accurate analysis, even though some of these factors are volatile:

-

The number of HCT (hematopoietic cell transplant) patients in the EU, North America, and globally.

-

The different categories of HCT.

-

The incidence rate of TA-TMA (transplant-associated thrombotic microangiopathy) for each HCT category.

-

Narsoplimab's market share over time.

-

The dosage required for each patient.

-

The target price per dose of Narsoplimab.

Given the volatility of some of these factors, this article will provide three estimations - low, medium, and high - to give the audience a comprehensive picture of what Narsoplimab's future revenue could look like by considering the movement of these key variables.

Patients Count

-

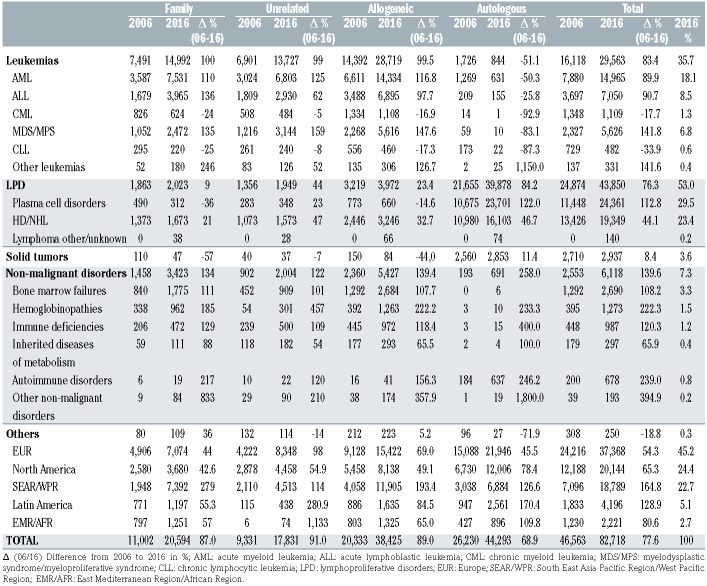

According to the National Institutes of Health data (Chart 1), there were 82,718 HCT operations (patients) in 2016, a 77% increase over the 10-year period from 2006.

-

Assuming the same increase rate since 2016, the number of HCT operations could potentially reach 145,455 in 2026.

Procedure Categories

-

In 2016, the proportion of autologous vs. allogeneic HCT procedures was:

-

Autologous: 58.7% (15,422 / (15,422 + 21,946))

-

Allogeneic: 41.3% (21,946 / (15,422 + 21,946))

For the allogeneic procedures, the low, medium, and high range estimates are 38%, 42%, and 46%, respectively.

-

In 2016, the EU and North America had a total of 23,560 allogeneic HCT procedures, with an estimated 41,595 in 2026. Globally, the estimated number is around 61,091.

TA-TMA Incidence,

-

Autologous HCT procedures have almost no incidence of TA-TMA.

-

Allogeneic HCT procedures have an estimated TA-TMA incidence rate of 12% (low), 15% (medium), and 20% (high).

Market Share,

-

It is assumed that Narsoplimab will quickly gain market share, with estimates of 50% (low), 70% (medium), and 80% (high).

Dosage,

-

Each patient requires 10 doses.

Target Price,

-

The target price per dose is based on the reference price of Eculizumab, which is $21,000 per dose.

(Chart 1: Origin: NIH.org)

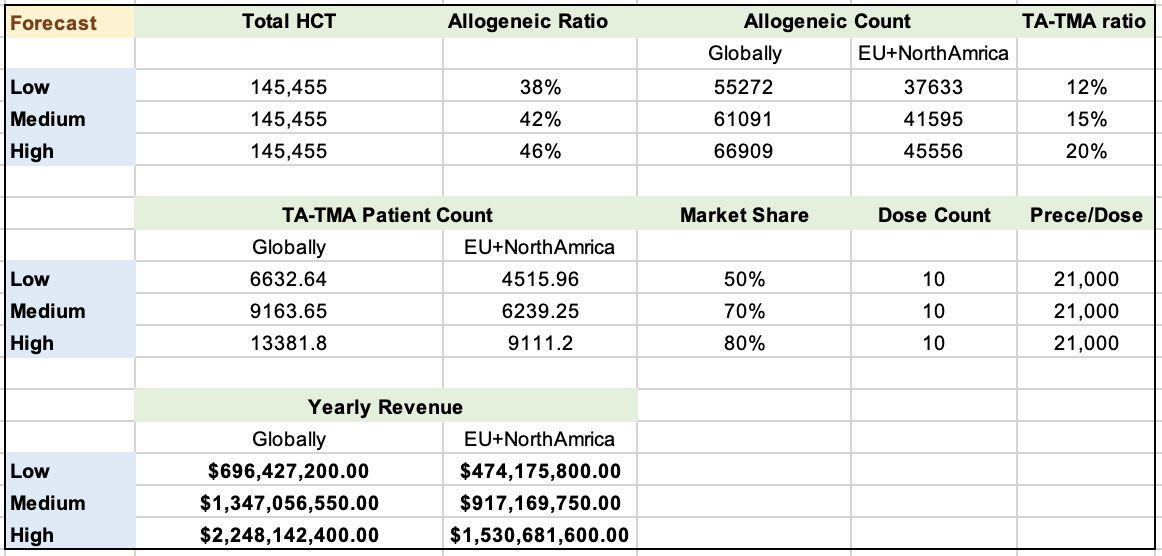

Revenue forecast

With above numbers, the following table summarizes the low, medium, and high predictions of Naroplimab's revenue. From the chart, with Narsoplimab sales in EU and NorthAmerica only, the revenue will be $474MM on the lower end, while $1.5B on the higher end; While if the sales expands globally, the annual revenue will be somewhere between $696MM and $2.25B.

The breakeven timeline

Based on the conservative revenue forecasts, if Narsoplimab can capture 30% of the projected target in 2026, it would equate to $157 million in sales. I am confident that the company will achieve break-even profitability by the end of 2026. Furthermore, with the drug's full potential, the company could potentially reach $1 billion in revenue. Factoring in this upside, the company's valuation could range anywhere from $5 billion to $10 billion. This valuation does not even account for the additional value that could be derived from future products in the company's pipeline.